03 Mar Celebrating Single Women Home Owners! Kicking Glass in Real Estate.

Celebrating Single Women Home Owners!

A Little Background

In 1981 The National Association of REALTORS® first started the Profile of Home Buyers and Sellers, and a stunning finding was made: single women outpaced single men in the housing market. In fact, single women were second only to married couples. Today, single women home buyers are a force. Single women are surpassing all odds in the housing market and purchasing homes with lower household incomes in an increasingly unaffordable housing market.

A stunning factoid about single women home buyers is that it was not until 1974 that women were legally protected to obtain a mortgage without a co-signer. Before the passage of the Fair Housing Act’s prohibitions against “sex” discrimination in housing-related transactions and the protections of the Equal Credit Opportunity Act, it was commonplace for a widow to need a male relative as a co-signer. Under federal law, women had no legal recourse for this or any other lending discrimination.

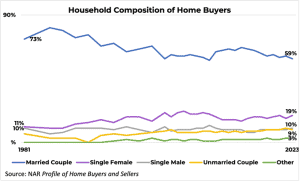

By 1981, 73% of home buyers were married couples, 11% were single women and 10% were single men. Today, those shares stand at 59% married couples, 19% single women, and 10% single men. The highest share of single women buyers was in 2006, when the share stood at 22%. Between 2016 and 2022, the share of single women will be between 17% and 19%.

An easy explanation for some of the rise in single women buyers was the drop in the share of Americans who are married. Using Census data in 1950, 23% Americans ages 15 and up had never been married. In 2022, that share stands at 34% of Americans. That translates into 37.9 million one-person households in the US today—29% of all households.

Why Are Women Buying More Homes

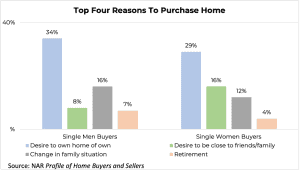

Both men and women are most likely to say they are purchasing for the desire to own a home of their own, but significantly more women purchase to be close to friends and family. Men are more likely to report buying because of a change in family situation, such as a divorce, death, or birth of a child. When collecting this data, if a buyer is single now, a data point not collected is if the buyer was once married and is now widowed or divorced. Still, in both scenarios, the proximity to friends and family may be important to women.

What is The Demographic of These Home Residences

One possible reason single women outperform single men purchasing homes is due to who is living in the home. Single women are more likely to have children under the age of 18 in the home and more likely to purchase a multigenerational home. Women may value the stability of homeownership in both scenarios. For instance, she knows where a child will attend school and would not need to risk moving homes and moving schools if the rent increases. She also knows what her home expenses will be, while she may have young adults who boomeranged back or could have elderly relatives in her home. These are factors not always high in the priority list for single male homeowners.

Finances _ Always a Challenge

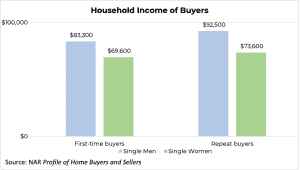

The next major question posed is finances. Women home buyers typically purchase a home as a first-time buyer at a household income of $69,600 compared to single men at $83,800. While male incomes do not match that of married couples or unmarried couples, their higher incomes do allow them more buying power than single women buyers. This is especially important when thinking of the difficulties of housing affordability. This may be one reason why the age of a single woman as a first-time buyer is a median of 38 while men have a median age of 33 as first-time buyers.

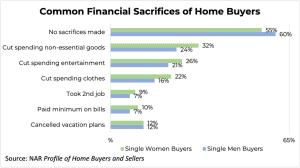

Given lower household incomes, women do make more financial sacrifices when purchasing. Forty-five percent of women make financial sacrifices compared to 40% of men who purchase homes. Common financial sacrifices include cutting spending on non-essential goods, entertainment, clothes, and even taking on a second job. These sacrifices only underscore how important homeownership is to women as these sacrifices outpace those of male buyers. Also, women are also more likely to move in with friends or family before purchasing to avoid paying rent. These sacrifices may add up and happen over a number of years, which also may contribute to the slightly higher age.

One notable difference is the source of down payment. Savings and sale from the last home are the most common sources for both single men and single women. However, there are two notable differences. Men use savings at higher rates while women use sale of their last home at a higher rate. Men are also more likely to sell stock or bonds, use their IRA, cryptocurrency, or take a loan from their 401k/retirement at 20% compared to women at 15%. Whereas 13% of single women use a gift from a friend or relative for their down payment compared to 11% of single men.

The View from 30,000 Feet

- The buying power of single women is strengthening as their workforce numbers rise sharply.

- Women now earn 58 percent of all college degrees nationwide.

- They earn more than their spouse 38 percent of the time.

- By 2025, the number of women in the workforce is expected to jump to 78 million — 8 million higher than the level in 2015.

The working woman today is different than previous generations. Forty years ago, 68 percent of women in their late 20s had both a husband and child. Today, that percentage has plunged to just 22 percent. Women may delay marriage or child-rearing to focus on their jobs first. But single women have shown they’re not afraid to step into home ownership alone. Single women accounted for 15 percent of all home purchases in 2015, while single men made up 9 percent, according to the National Association of REALTORS®’ 2015 Profile of Homebuyers and Sellers.

Since 1974 the economic momentum of women in the workforce coincides with single women home ownership. Both have undergone significant growth and represent a formidable growth segment. Women have, early on, recognized the value of Home Ownership in terms of stability, economic growth and the ability to serve family needs no matter what generation they are dealing with. They have also demonstrated more determination and willingness to make sacrifices to achieve their goals than their single male counterparts.

Women today now run some of the largest and most influential companies on the planet…so the sky is the limit! Glass ceilings have been shattered. Yet even single women starting out are much more inclined to purchase their home as a key step to building economic independence.

We believe the scenario of single women and home ownership is yet again another example of “Women Kicking Glass” !

For More Information about Our Single Women Kicking Glass Support Program please Contact…

Missy Adams, Realtor

Team Leader

Adams Home Team

Keller Williams Gateway

20 Trafalgar Square, Suite 101

Nashua, NH 03063

Cell: 603-320-6368

Office: 603-883-8400

Email: missyadamsrealestate@comcast.net

CLICK HERE for more information

Twitter: @missyadamsnh #AdamsHomeTeam

Sign up for my Mobile App and search anywhere, any time……. Click Here

Sorry, the comment form is closed at this time.